|

GUANGZHOU, China, Aug. 26, 2024 /PRNewswire/ -- According to International Energy Agency's forecasts, renewables will surpass coal to become the largest source of global electricity generation in 2025 and account for over 42% share in 2028, signifying a significant shift in the global power mix. In China, there has been an accelerating transformation with renewable power generation capacity has surpassed coal-fired electricity in the first half of 2024, capturing 38% of the market share. [1] This rapid evolution in the new energy sector has created attractive investment opportunities in area such as clean, renewable energy and low-carbon transition of thermal power plants and steel manufacturing.

As China's largest mutual fund manager, E Fund Management ("E Fund") is dedicated to serving both domestic and international investors through a range of relevant ETFs, including CSI New Energy ETF (Code: 516090), E Fund Carbon Neutral 100 ETF (Code: 562990), and E Fund CNI New Energy Battery ETF (Code: 159566), the first two are included in mainland China—Hong Kong ETF Connect.

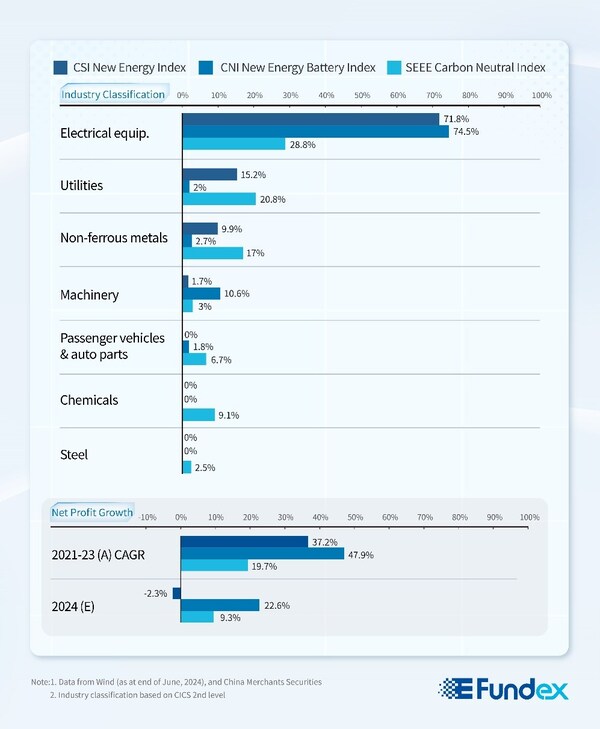

Among these, CSI New Energy Index primarily focuses on clean and renewable energy and more than 70% of its constituents involved in electrical equipment sector. Conversely, SEEE Carbon Neutral Index differentiates as a more comprehensive index. As of 2023, its composition was weighted at 67.2% towards companies engaged in clean, renewable energy and 32.8% in low-carbon transition.

Beyond new energy industry, China is driving a comprehensive green transformation towards a more sustainable economy and the electric vehicle industry serves as a prime example. Data from China Passenger Car Association revealed that in July, retail sales of new energy passenger car outstripped that of conventional vehicles with the monthly penetration rate exceeding 50% for the first time. The CNI New Energy Battery Index is well poised to capture this trend, particularly focusing on energy storage system (ESS) battery manufacturing and integration. The only ETF dedicated to this index, E Fund CNI New Energy Battery ETF, aimed to benefit from the growth potential of its index constituents, with an expected net profit growth rate of 22.6% for 2024.

About E Fund

Established in 2001, E Fund Management Co., Ltd. ("E Fund") is a leading comprehensive mutual fund manager in China with close to RMB 3.3 trillion (US$ 454 billion) under management.[2] It offers investment solutions to onshore and offshore clients, helping clients achieve long-term sustainable investment performances. E Fund's clients include both individuals and institutions, ranging from central banks, sovereign wealth funds, social security funds, pension funds, insurance and reinsurance companies, to corporates and banks. It is a pioneer and leading practitioner in responsible investments in China and is widely recognized as one of the most trusted and outstanding Chinese asset managers.

Note:

[1] Data from China Electricity Council

[2] As at Jun 30, 2024. AuM includes subsidiaries. Source: PBoC, Wind.

source: E Fund Management

樂本健【年度感謝祭】維柏健及natural Factors全線2件7折► 了解詳情